2,000+

Customers

Everything you need, in one place

With our software, you can simplify your workflow and maintain a high level of organization by having all your essential tools in one place. Streamlining your processes helps you save time and increase productivity, which ultimately leads to a more efficient and profitable business.

Reputation and Reviews

By just a few clicks, you can automate your online reviews and handle all your responses in one location.

Automated Messaging

Take charge of your messages with a unified inbox that handles text, Facebook messages, Google messages, and other platforms.

Webchat integration

Boost your lead and sales conversions by using Webchat to engage with more website visitors.

Payments and Invoices

Easy text 2 pay client invoicing. Simplify your client invoicing & get paid faster.

Missed Call Text Back

When you're away, have FOXAF CRM follow up via text so you never lose another customer

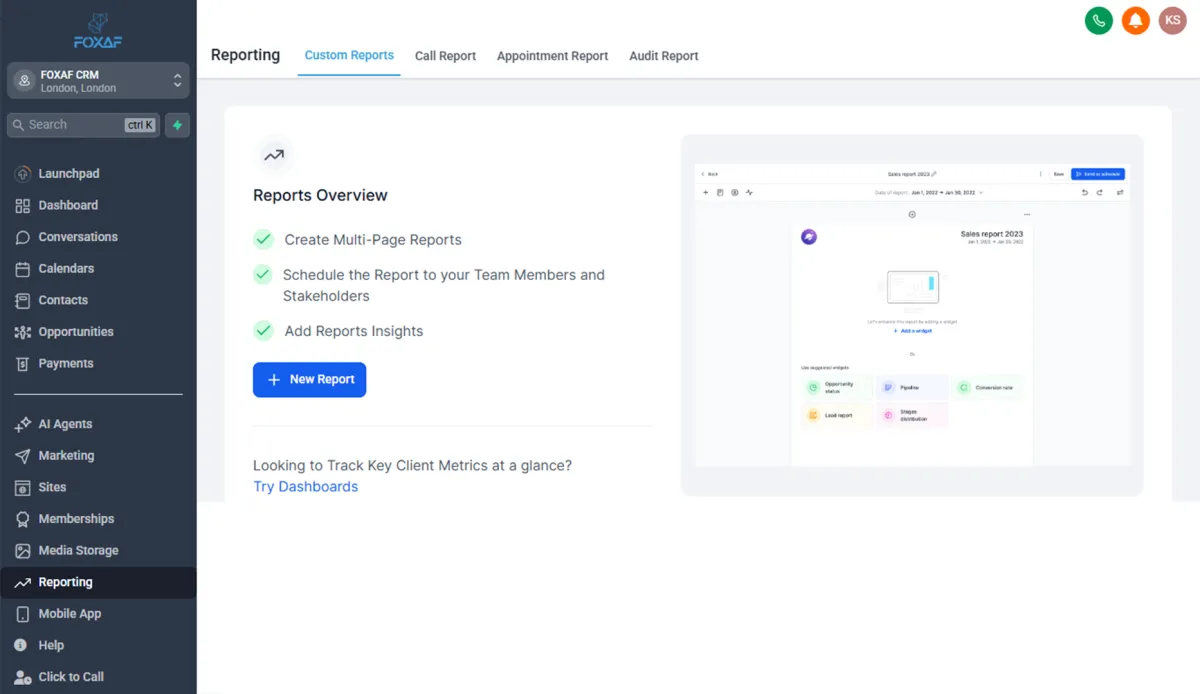

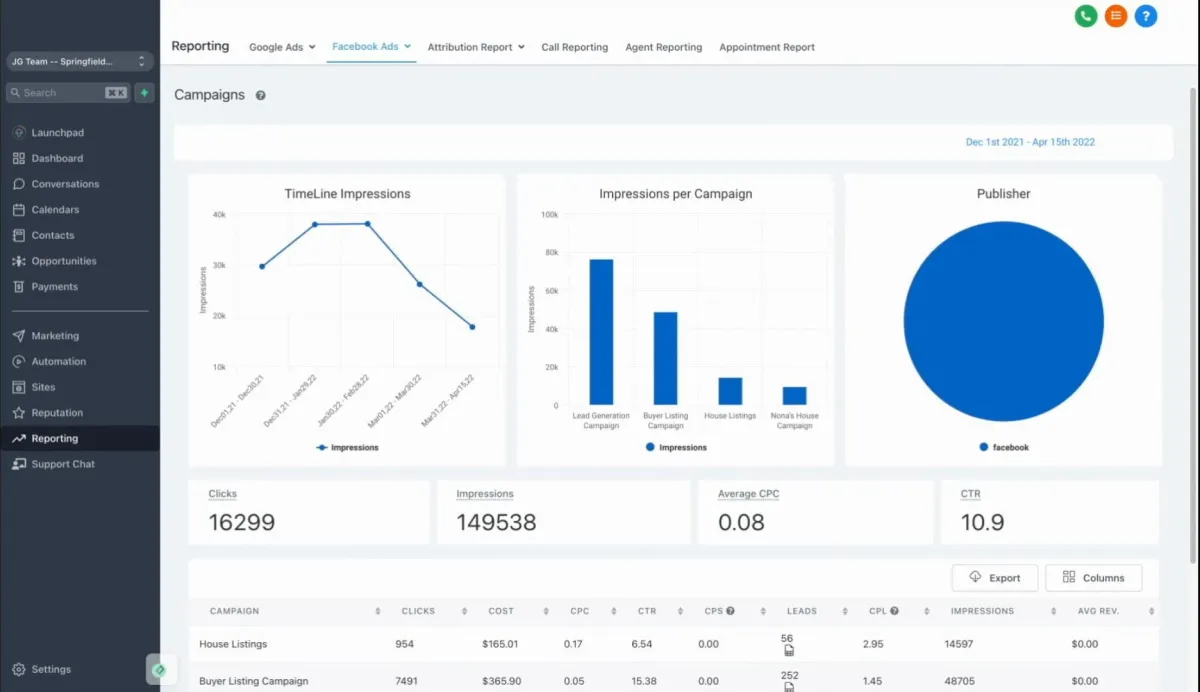

Dashboard and Reporting

Expand your audience and gain insights into the origin of new leads with our software and optimize your marketing strategies.

Replacement of $7000 Worth Tools

| FEATURES | REPLACES | OTHER TOOLS |

|

|---|---|---|---|

| CRM & Pipeline Management |

|

|

|

| Unlimited Sales Funnels |

|

|

|

| Website Builder |

|

|

|

| Surveys & Forms |

|

|

|

| Email Marketing |

|

|

|

| 2-Ways Sms Marketing |

|

|

|

| Booking & Apponitments |

|

|

|

| Work Flow Automation |

|

|

|

| Courses/Products |

|

|

|

| Call Tracking |

|

|

|

| Reputation Management |

|

|

|

| Tracking & Analytics |

|

|

|

| Communities |

|

|

|

| OVERALL PRICE | $7,064 PER MONTH | $197 PER MONTH |

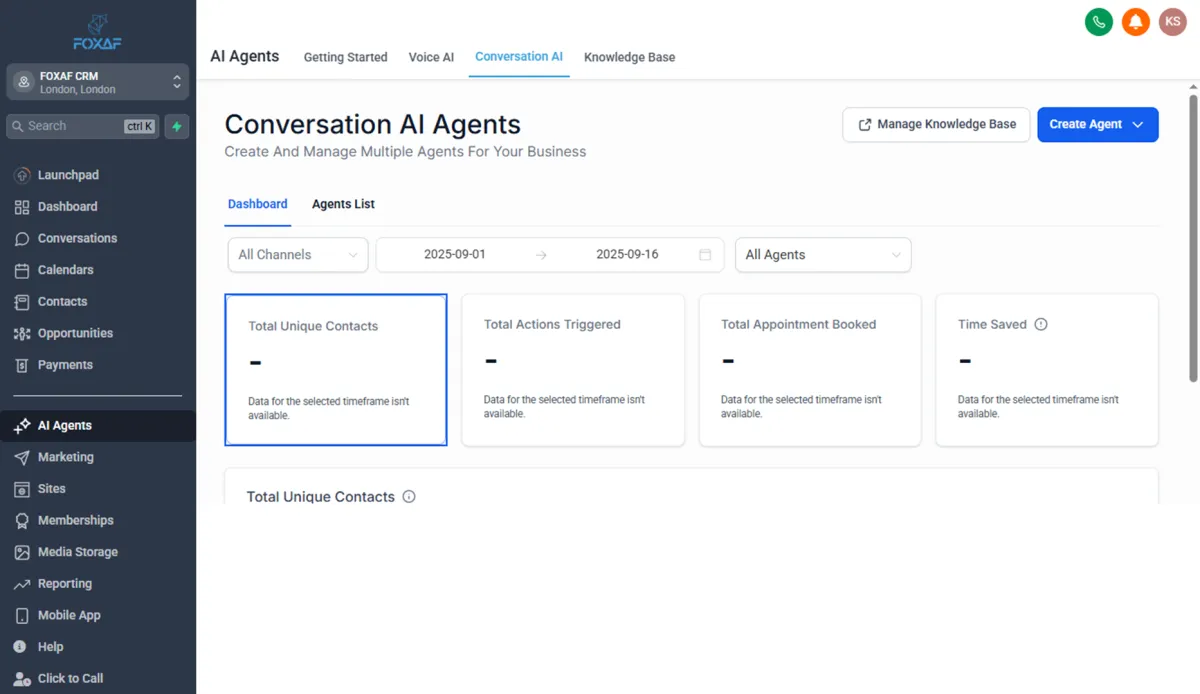

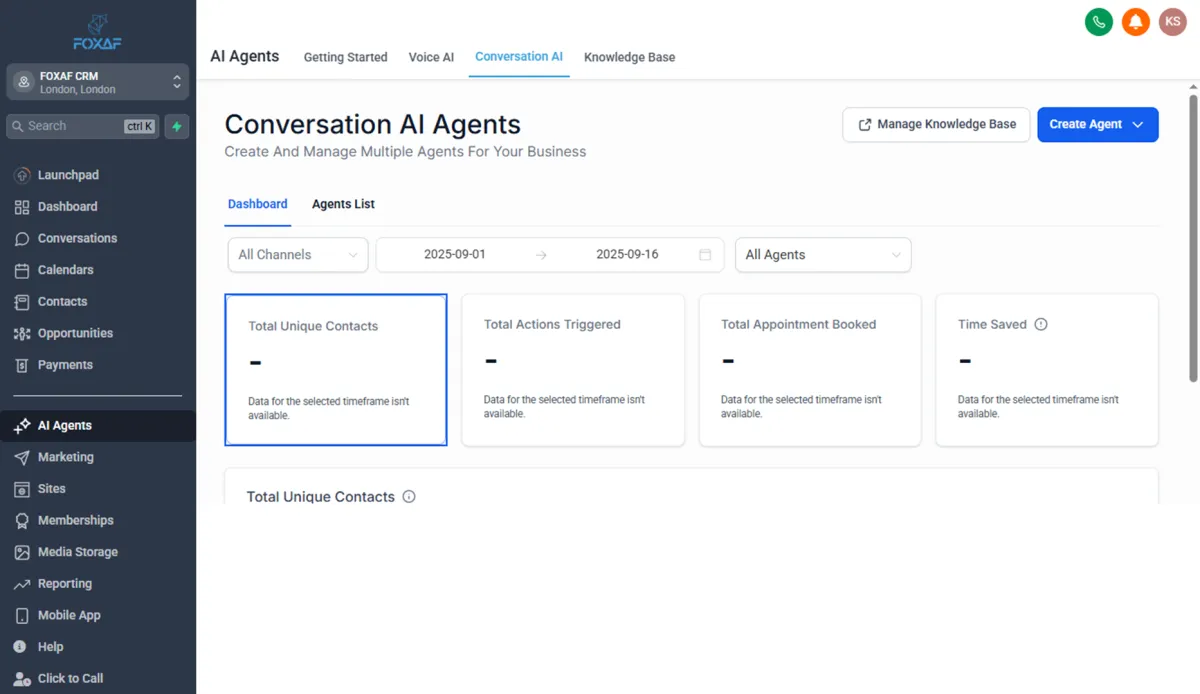

All-in-One Automation to Simplify Your Tech Stack

Stop juggling a dozen apps – Foxaf replaces them all. Capture leads, nurture prospects, schedule appointments, send invoices, request reviews – everything happens inside Foxaf’s unified platform. No more duct-taping different tools together or wrestling with clunky integrations. With Foxaf, you log in once and get it all done.

Replace Multiple Tools

Foxaf combines CRM, email marketing, funnel builder, calendar, payment processing, and more in one platform – saving you time and money versus managing separate software.

One Source of Truth

All your contacts and conversations are organized in one system, giving you a 360° view of your business.

Simple & Scalable

An intuitive interface means anyone can use it, and it’s robust enough to grow with your business without costly upgrades.

Capture Leads 24/7, Automatically

Never miss a lead again. Foxaf CRM automatically captures leads from your website, landing pages, social media, and ads – even while you sleep. Every inquiry or form submission is instantly logged into the CRM and funnelled into your sales pipeline.

Web & Funnel Forms

Build high-converting landing pages, surveys, and web forms that feed leads straight into Foxaf. No manual data entry needed.

Live Chat & Webchat

Turn website visitors into leads with an integrated chat widget that greets prospects and captures their contact info.

Import Any Source

Seamlessly bring in leads from Facebook lead ads, Google, or your existing lists – Foxaf keeps all your prospects in one place.

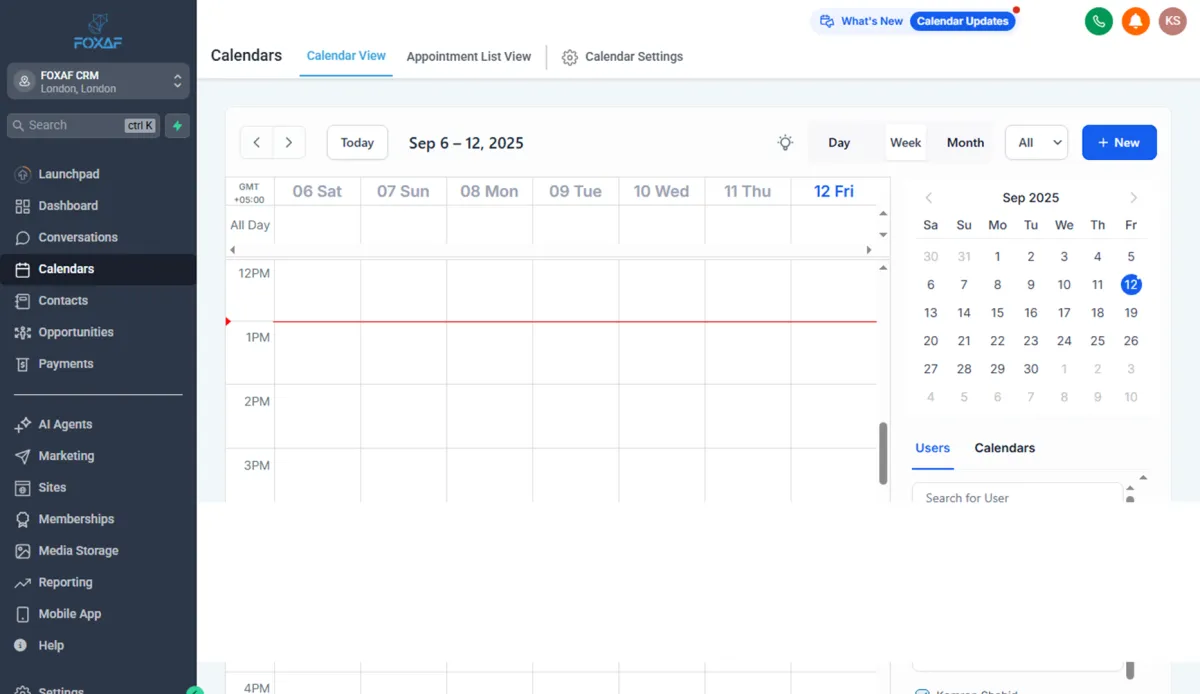

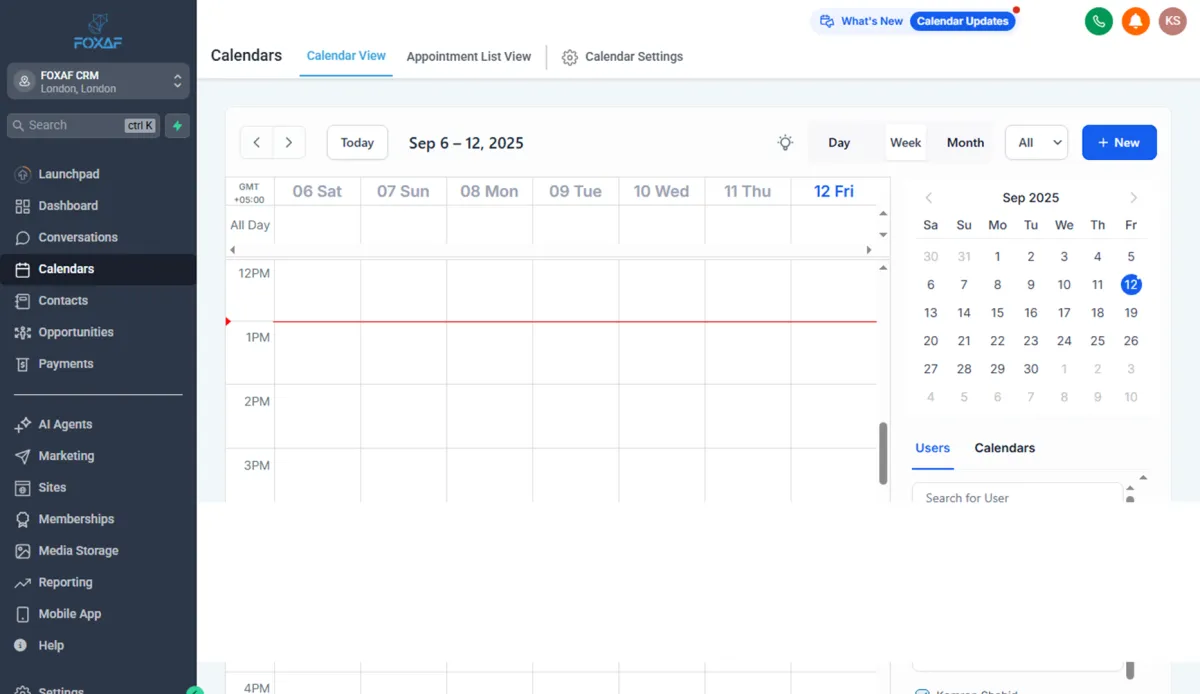

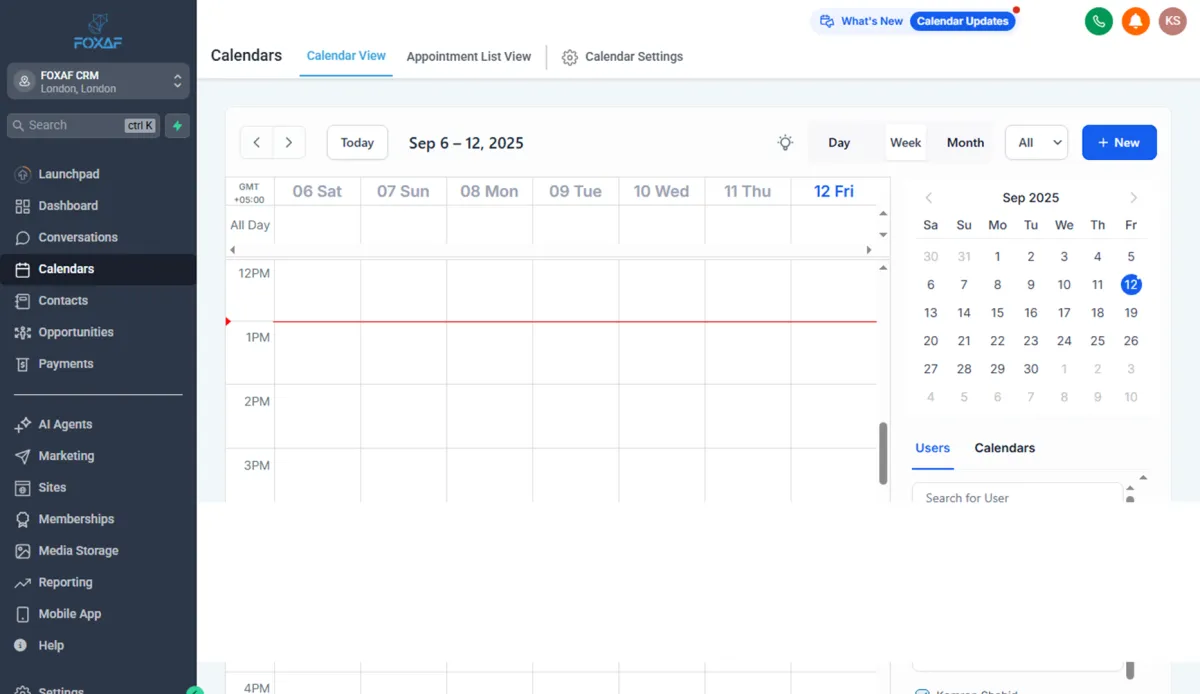

Effortless Booking & Scheduling

Let interested prospects book appointments on their own without back-and-forth emails. Foxaf CRM includes a built-in calendar booking system that syncs with your Google or Outlook calendar. Prospects can self-schedule calls or meetings at times you designate, and Foxaf handles the rest.

Online Calendar

Embed your Foxaf scheduling calendar on your site or landing pages. It’s never been easier to fill your calendar with qualified appointments.

Automated Reminders

Reduce no-shows with automatic email/text reminders before each meeting. Customers show up ready, and you close more deals.

Integrated Booking Workflow

An intuitive interface means anyone can use it, and it’s robust enough to grow with your business without costly upgrades.

Streamlined Sales Pipeline Management

Stay on top of every deal with visual sales pipelines that make tracking opportunities a breeze. Foxaf CRM gives you full visibility of your customer journey – from new lead to won sale. Drag-and-drop leads between stages, add notes or tasks, and watch your conversion rates climb.

Custom Pipelines

Tailor stages to your process (e.g. New Lead, Contacted, Demo Scheduled, Won). Foxaf lets you manage multiple pipelines for different products or teams.

Deal Cards & Tasks

Each lead becomes a card you can move across stages. Add tasks or reminders so you always follow up at the perfect time.

Analytics & Forecasting

Real-time pipeline metrics show you conversion rates and projected revenue, so you can focus on the hottest opportunities.

Get Paid Faster with Integrated Payments

No more chasing invoices – Foxaf CRM helps you collect payments effortlessly. Create invoices or payment links in a few clicks and send them via text or email. Your customer can pay online instantly, and Foxaf records the payment in your contact’s timeline.

Invoices & Quotes

Generate professional-looking estimates and invoices right inside Foxaf. When a customer is ready, convert a quote to an invoice and get paid in one step.

Text-to-Pay Links

Send a secure payment link via SMS or email. Clients can pay on their phone in seconds, and you get notified immediately.

Stripe & PayPal Integration

Foxaf connects with popular payment gateways so you can accept credit cards with ease. All transactions are tracked for easy bookkeeping.

Boost Your Reputation on Autopilot

Turn happy customers into 5-star reviews with Foxaf’s reputation management. The system automatically requests reviews from your clients on Google, Facebook, or other platforms after each sale or appointment. Build social proof for your business without lifting a finger.

Automated Review Requests

Set triggers to send a friendly review request via text or email after a purchase or service. Foxaf guides customers to your review sites to share their feedback.

Centralized Reviews Inbox

Manage all your reviews and responses in one place. Get notified of new reviews and reply quickly to show you care.

Boost Online Visibility

More positive reviews mean higher rankings in local search and more trust from new prospects – Foxaf helps you amplify your reputation.

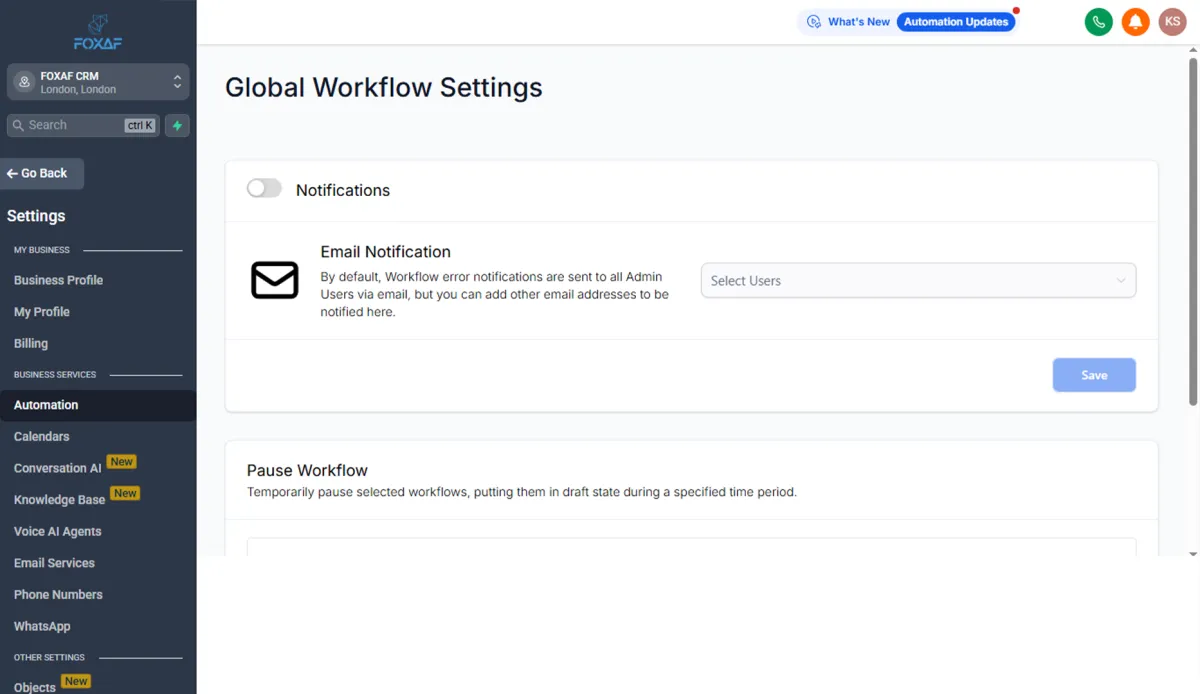

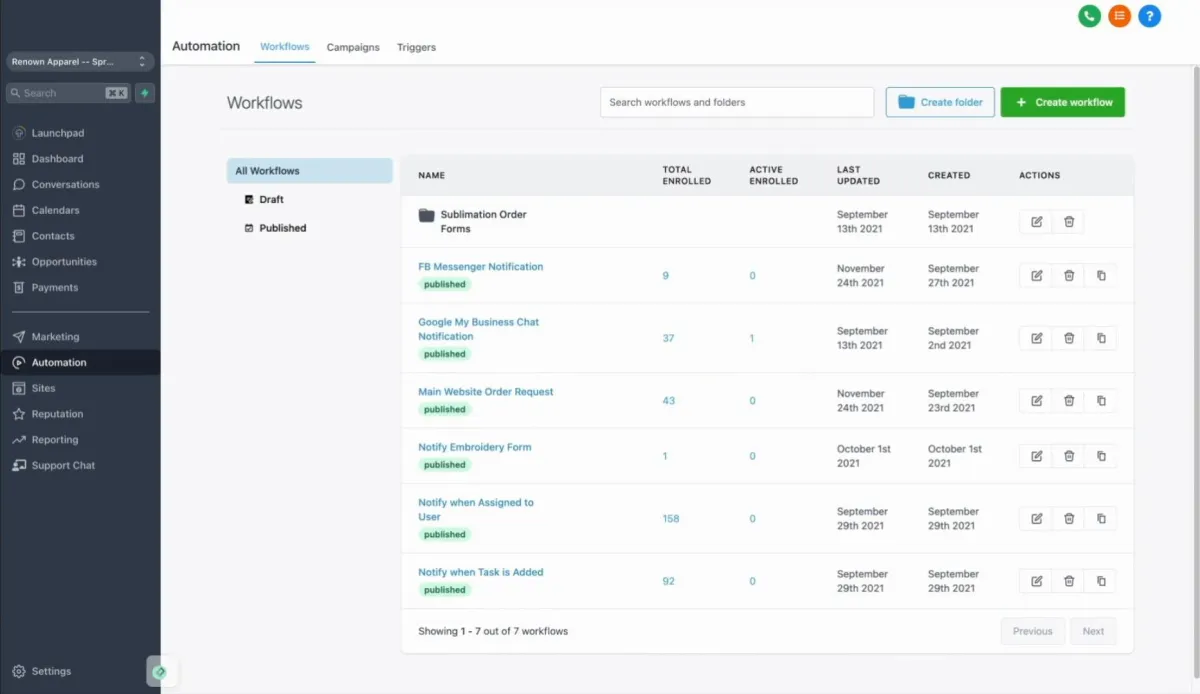

Custom Workflows & Automation

Every business has unique processes. Foxaf’s workflow automation lets you create custom triggers and actions tailored to your needs – no coding required. It’s like having a 24/7 virtual assistant for your repetitive tasks.

If This Then That Rules

Easily set up triggers (e.g. “When a new lead is captured then ... send a welcome email and assign to a sales rep”). You define the rules, Foxaf does the work.

Multi-Step Campaigns

Build sophisticated automation flows with delays, conditional logic, and personalized actions that guide leads from introduction to conversion seamlessly.

Save Time & Eliminate Human Error

Automate the busywork – follow-ups, data entry, reminders – so nothing falls through the cracks and your team stays focused on high-value activities.

For Coaches & Consultants

Coaches, consultants, and advisors: Foxaf CRM is your secret weapon to win more clients while freeing up time. Spend less time on administrative tasks and more time coaching. Foxaf automates your marketing funnels and client communications from start to finish: attract prospects, schedule them into your calendar, follow up automatically, and even collect payments for your coaching packages. You’ll never have to chase a lead or miss a follow-up, meaning you can close more deals and change more lives through your coaching.

Fill Your Calendar

Use Foxaf landing pages and webchat to capture prospects and let them book their own discovery calls with you.

Build Relationships at Scale

Set up nurturing email/SMS sequences that share valuable tips with leads, warming them until they’re ready to become clients – without you manually sending a thing.

Get Paid Effortlessly

Send invoices or offer one-click online payments for your programs. Foxaf keeps track of who paid, so you don’t have to.

For eCommerce Businesses

Online store owners and e-commerce entrepreneurs: Supercharge your customer lifetime value with Foxaf CRM. While your e-commerce platform handles orders, Foxaf handles the marketing and customer follow-up that turns one-time buyers into repeat customers. Automatically recover abandoned carts, send personalized post-purchase follow-ups, and gather reviews – all from one dashboard. Foxaf bridges the gap between shopping cart and CRM, giving you powerful tools big retailers use, on autopilot.

Cart Abandonment Recovery

Don’t lose sales when customers leave items in their cart. Foxaf can automatically send a reminder email or text with a promo to entice them back to complete the purchase.

Customer Loyalty Campaigns

Set up drip campaigns to cross-sell and upsell your customers based on what they bought. For example, after someone buys product A, Foxaf can email them a week later with a related recommendation or special offer.

Review Generation

After each purchase, Foxaf requests a product review or testimonial from your customer, helping you build trust for your store and boost conversions for new shoppers.

World-Class Support & Guidance

When you choose Foxaf, you get more than software – you get a team committed to your success. We pride ourselves on providing dedicated support and resources to help you maximize the platform. Have a question or need help? Real humans at Foxaf are just a call or chat away.

Personalized Onboarding

Get started fast with one-on-one onboarding sessions. We’ll help import your data, set up your funnels and workflows, and ensure Foxaf is tailored to your business.

24/7 Support & Training

Access our knowledge base, how-to guides, and responsive support team anytime. We’re here to troubleshoot and offer expert tips whenever you need.

Your Success Partner

We’re invested in your growth. From marketing advice to technical assistance, consider us an extension of your team focused on helping your business thrive with Foxaf.

Instant Follow-Ups to Nurture Every Prospect

Speed wins deals. Foxaf CRM triggers immediate follow-ups the moment a new lead comes in – via text, email, or even Facebook message – so your prospects get a rapid response every time. Automate your nurture sequences and never let a hot lead grow cold.

Multi Channel Messaging

Reach leads where they are. Foxaf’s unified inbox handles SMS, email, WhatsApp, Facebook Messenger and more, ensuring you respond on every channel from one screen.

Done For You Drip Campaigns

Set up personalized email/SMS sequences that educate and warm up prospects over days or weeks. Foxaf sends the right message at the right time automatically.

Missed-Call Text Back

If someone calls and you’re unavailable, Foxaf instantly sends a text to let them know you’ll be in touch – no more losing customers when you can’t answer the phone.

For Local Service Businesses

Local service providers – from clinics and consultancies to contractors and salons – can rely on Foxaf CRM as a 24/7 digital assistant. It ensures you never miss a customer inquiry and helps you deliver top-notch service every step of the way. Website contact form submissions, Facebook messages, phone calls – however people find you, Foxaf captures and organizes it. New leads get instant replies and booking links, appointments get scheduled without phone tag, and customers receive appointment reminders and follow-ups automatically. The result? More bookings, fewer no-shows, and a stellar reputation in your community.

Immediate Response

Impress potential clients with near-instant replies. For example, if someone submits a quote request after hours, Foxaf can instantly text back “Thanks for reaching out! We’ll contact you first thing in the morning – in the meantime, here’s a link to schedule a call.”

Easy Appointment Management

Let clients book services or consultations online at their convenience. Foxaf sends confirmations and reminder texts, so people show up on time and prepared.

Reputation Boost

Foxaf will proactively ask your happy customers for Google or Facebook reviews, helping you build a strong local presence that attracts even more business.

For Marketing Agencies

Agencies and consultants: Foxaf CRM is built to help you scale your agency and your clients’ results simultaneously. Manage all your client campaigns in one professional platform – no more Frankensteining multiple tools and logins. You can track leads, launch marketing campaigns, and automate client reporting all from Foxaf. Deliver more value to clients by responding to leads faster and nurturing prospects better, which means better ROI on their ad spend. Plus, Foxaf offers white-label capabilities – brand it as your own platform and even resell CRM access to clients for an additional revenue stream. It’s the ultimate win-win: your agency runs smoother, and your clients see bigger wins.

Multi-Client Management

Easily toggle between different client accounts or locations. Foxaf keeps each client’s leads, pipelines, and campaigns organized, so you can stay on top of all client work.

Client Value Add

Use Foxaf to set up automated funnels and follow-up systems for clients. They’ll get more leads and conversions thanks to your service (powered by Foxaf behind the scenes), making you look like a rockstar agency.

White-Label & Resell

Take your agency to the next level by offering Foxaf CRM to clients under your own brand. You control the pricing, and Foxaf handles the heavy lifting – giving you a new recurring income stream.

How It Works – Get Started in 3 Easy Steps

Getting up and running with Foxaf CRM is quick and hassle-free. In just a few steps, you’ll have your very own sales machine up and running:

Sign Up & Setup

Create your Foxaf account and use our simple setup wizard. Connect your existing email, phone, and calendar, and import any current contacts with a click.

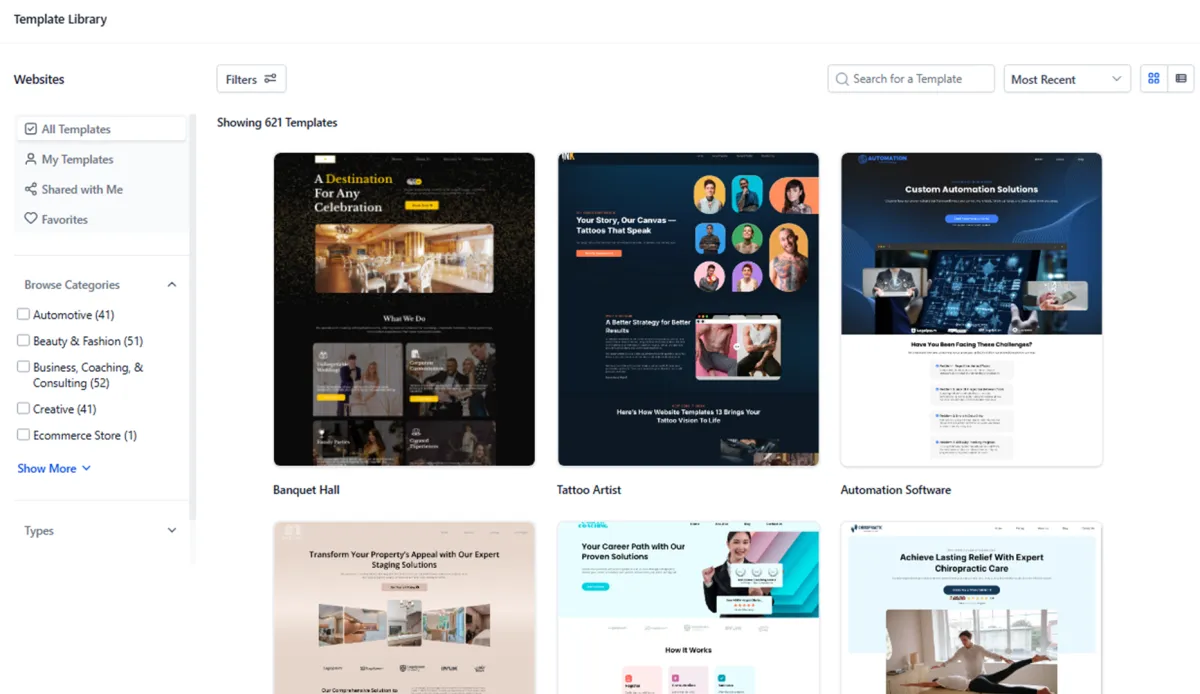

Customize & Launch

Choose from pre-built funnels, email templates, and automation workflows – or customize your own. Set your business hours, calendar availability, and review request settings. Foxaf is highly flexible to fit your needs.

Automate & Grow

Turn on the automation and let Foxaf do the heavy lifting! Watch as new leads flow in, appointments fill up, follow-ups go out on time, and sales start increasing. Monitor it all on your real-time dashboard and tweak as needed.

Foxaf vs. The Competition

Why Foxaf CRM outpaces other platforms? Simply put, Foxaf delivers more value and simplicity compared to piecing together traditional CRMs or marketing tools. Here’s how we stack up against some well-known solutions:

Feature

Tool Stack

Flat monthly rate

No per-contact fees

Marketing automation

User-friendly interface

All-in-one solution

Dedicated support

Seamless Integration with Your Favorite Apps

Already using tools you love? Foxaf CRM plays nice with others. It integrates with popular apps and services so you can keep your current workflow and data in sync. Whether it’s your Google tools or other business software, Foxaf connects it all.

Calendar & Email

Sync with Google Calendar, Outlook, Gmail, and more – keep your communications and scheduling unified.

Finance & E-Commerce

Integrate with QuickBooks for accounting or Shopify/WooCommerce to capture online purchase data into Foxaf.

Thousands of Apps via Zapier

Foxaf connects to over 3,000+ apps through Zapier, so you can integrate virtually anything and extend Foxaf’s functionality as needed.

What Our Customers Are Saying

Testimonials from real Foxaf users across industries

"Foxaf CRM completely changed my business. In just three months, I went from struggling to follow up with leads to having a fully booked calendar of coaching clients. The automation is like having an assistant that works 24/7 – my response time and conversion rates have skyrocketed!"

Jane S

Business Coach

"We saw a 30% increase in monthly revenue after switching to Foxaf. I’m a local home services contractor, and I used to miss calls and forget follow-ups. Now Foxaf captures every inquiry from my website and even texts back customers if I’m busy. It’s like I never miss an opportunity. Plus, the review automation helped us go from 5 to 50 Google reviews in no time!"

John D

Home Services Business Owner

"Our marketing agency’s secret weapon is Foxaf. We consolidated lead funnels, email campaigns, SMS follow-ups, and CRM into one platform. Managing client campaigns is so much smoother now – and clients are closing more deals because we respond to leads instantly. We even offer our branded version of Foxaf to clients for added value. It’s a game-changer for us and for them."

Alex R

Agency Co-Founder

Frequently Asked Questions

Is Foxaf CRM difficult to use if I’m not tech-savvy?

Not at all. Foxaf is designed for ease of use. The interface is clean and intuitive, and you don’t need any coding or technical skills to automate your business. Plus, our team provides onboarding and support to help you get comfortable quickly. If you can operate email and a smartphone, you can master Foxaf CRM.

Can I use just parts of Foxaf CRM and keep some of my existing tools?

Yes, Foxaf is flexible. You can use as much or as little of the platform as you need. For example, you might start by using Foxaf for lead follow-up and appointment booking while keeping your current e-commerce system – Foxaf will integrate with it. Over time, many users find it convenient to migrate more tasks into Foxaf to simplify things, but you’re free to integrate Foxaf with your favorite apps via built-in integrations or Zapier.

Will Foxaf CRM work for my industry/business?

Absolutely. Foxaf is used by a wide range of businesses: coaches, consultants, digital agencies, retail and e-commerce, home services, medical practices, real estate – you name it. If your business relies on leads, appointments, sales, or repeat customers, Foxaf can automate and improve it. It’s highly customizable, so you can tailor pipelines and workflows to fit your specific processes.

How is Foxaf CRM priced?

Foxaf offers simple, transparent pricing with plans that include all core features (lead capture, automation, pipeline, etc.). There are no per-contact or per-email fees, unlike some CRMs. You simply choose a monthly plan based on your business needs, and you can add an annual option for a discount. No hidden costs, and you can cancel or upgrade at any time. (And remember – because Foxaf replaces many other tools, our customers often save money overall!)

What if I need help or want a custom setup?

We’re here for you. Foxaf provides 24/7 support via chat, email, and phone. We also have an extensive Help Center with tutorials and an optional dedicated account manager service if you want hands-on assistance managing your system. From migrating data to crafting the perfect automated campaign, our experts will guide you. You’ll never be left on your own – we succeed when you succeed.

Ready to Transform Your Business with Automation?

It’s time to build your ultimate sales machine. Don’t let another lead slip through the cracks or waste another hour on tasks that Foxaf can do for you. Join the forward-thinking business owners who have turbocharged their growth with Foxaf CRM.

Take the leap toward greater productivity, higher sales, and more freedom.

FOXAF CRM © 2025, All rights reserved.